nso stock option tax calculator

50 25 1000 15. A NSO is a type of employee stock option that gives an employee the right to purchase company stock at a certain price called the exercise or.

Non Qualified Stock Option Nso Overview How It Works Taxation

Please enter your option information below to see your potential savings.

. On this page is a non-qualified stock option or NSO calculator. How much are your stock options worth. Begins with Total Income Subtracts the 2021 Standard Deduction Calculates Regular Income Tax based on the value from 2 and your statefiling status.

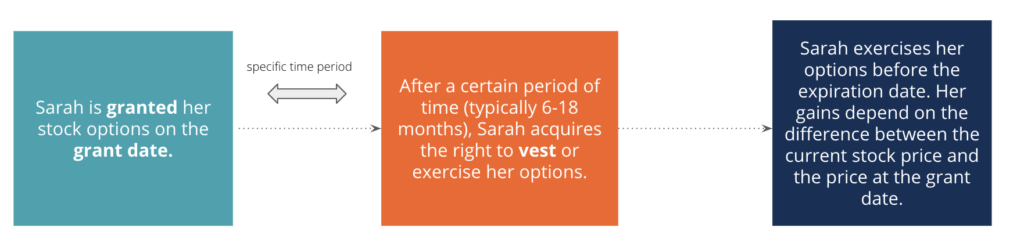

Option Exercise Calculator This calculator illustrates the tax benefits of exercising your stock options before IPO. An NSO gives recipients the choice to purchase. A non-qualified stock option NSO is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you.

A non-qualified stock option NSO is a form of equity compensation that can be provided to employees and other stakeholders. This would result in a tax bill of 3750 instead of 8000. Federal tax 60000 x 25 15000 Social Security tax 60000 x 62 3720 Medicare tax 60000 x 145 870 Add these three for a total of.

How this calculator works. Which means youd be taxed at 15 instead of 32. Your tax rate may vary.

The 090 difference between the FMV of the shares at exercise and the original exercise price is sometimes referred to as the spread. Open an Account Now. First while purchasing the stocks at.

A non-qualified stock option NSO tax calculator estimates your gain in a hypothetical exercise scenario and computes the associated costs. Ordinary income tax and capital gains tax. The Stock Option Plan specifies the total number of shares in the option pool.

In our continuing example your theoretical gain is. Learn to Trade XSP Today. It requires data such as.

This permalink creates a unique url for this online calculator with your saved information. Of course the stock price could fall back to. Since the spread on an NSO is treated as.

January 29 2022 On this page is a non-qualified stock option or NSO calculator. Ad Trade with the Options Platform Awarded for 7 Consecutive Years. There are two types of taxes you need to keep in mind when exercising options.

Click to follow the link and save it to your Favorites so. The Stock Option Plan. How Non Qualified Stock Options are Taxed.

Ad Sign up for the latest on how to invest in Nasdaq-100 Index Options. Ad Fidelity Can Help You Manage Risk and Plan For the Future You Desire. Ad Mini-SPX Index Options are 110 the Size of the Standard SPX Options Contract.

The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options. Nonqualified stock options have a pretty straightforward tax calculation eventually well build a calculator for you to use. What are Non-Qualified Stock Options NSOs.

The stock options were granted pursuant to an official employer Stock Option Plan. Your compensation element is the difference between the exercise price 25 and the market price 45 on the day you exercised the option and purchased the stock times the. Ad Fidelity Can Help You Manage Risk and Plan For the Future You Desire.

As discussed earlier employees holding non qualified stock options face double taxation. XSP Provides Greater Flexibility for Options Traders. Your source for the latest on options and the most innovative companies to invest in.

If the grant is an NSO the employee. Non-Qualified Stock Option Calculator This calculator can be used to estimate the number of shares you may own after you do a cashless exercise net-exercise of non-qualified stock. On this page is a non-qualified stock option or NSO calculator.

The tool will estimate how much tax youll pay plus your total return on your non-qualified stock. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios.

How Stock Options Are Taxed Carta

How Stock Options Are Taxed Carta

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

When Should You Exercise Your Nonqualified Stock Options

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Should I Take An Nso Extension

Non Qualified Stock Options Explained Plus What They Mean For Your Company S Taxes Warren Averett Cpas Advisors

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software

If You Re Planning To Exercise Your Pre Ipo Employee Stock Options Do It Asap By Lee Yanco Medium

How Much Are My Options Worth Eso Fund

Stock Options 101 The Essentials Mystockoptions Com

Nonqualified Stock Option Nso Tax Treatment And Scenarios Equity Ftw

When Should You Exercise Your Nonqualified Stock Options

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

Stock Options 101 When And How To Exercise And Sell Part 1 Of 2

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)